The global medical wearables market is undergoing a seismic shift, transforming from a collection of niche consumer wellness trackers into a foundational pillar of modern healthcare. This strategic outlook for 2025–2030 provides a data-driven analysis for C-suite executives, underscoring a central thesis: the future is defined by the powerful convergence of advanced sensor technology, artificial intelligence (AI), and enhanced connectivity.

This paradigm shift is creating a landscape of exponential growth. Market forecasts are highly aggressive, with projections suggesting the global market size could reach over USD 168 billion by 2030, a substantial leap from 2024 valuations. This expansion is most pronounced in high-impact segments like therapeutic devices and remote patient monitoring (RPM), with some categories anticipating a Compound Annual Growth Rate (CAGR) exceeding 26%.

The most significant opportunities lie in three key areas:

- Predictive Health Insights: Developing AI-driven analytics platforms that transform raw physiological data into actionable, predictive clinical insights.

- Seamless Sensing: Pursuing truly non-invasive sensor technologies to unlock new patient demographics and vastly improve user compliance (e.g., needle-free glucose monitoring).

- Active Intervention: Creating digital therapeutics and closed-loop systems that evolve beyond passive monitoring to provide active, real-time clinical intervention.

For decision-makers, the mandate is clear: success won’t be achieved by simply building better hardware. It will be determined by the ability to create secure, interoperable platforms that convert data into clinical-grade information.

This requires a strategic roadmap prioritizing three key pillars:

- Investment in R&D for cutting-edge sensing and AI.

- Proactive anticipation of evolving regulatory pathways (e.g., FDA clearance).

- Establishing a brand identity built on the foundational principles of user trust and data security (Privacy-by-Design).

This report examines the key drivers, emerging technologies, market segments, and strategic considerations that will define the medical wearables landscape through 2030, offering actionable insights for executive decision-making.

- Market Dynamics & Growth Drivers (2025–2030)

- Key Drivers of Market Expansion

- Geographic Insights: Regional Dominance and Emerging Opportunities

- The New Wave of Medical Wearables: Technologies & Applications

- The Strategic Imperative of AI and Edge Computing

- Navigating the Business and Regulatory Landscape

- The 2030 Vision: Strategic Recommendations for Leadership

- From Strategy to Solution: The Developex Advantage

- Final Thoughts

Market Dynamics & Growth Drivers (2025–2030)

The medical wearables market is in an accelerating, high-growth phase, presenting a robust, expanding opportunity for investment. However, executives must interpret market projections with a critical eye, as forecasts vary significantly based on scope.

Global market projections for 2030 range dramatically, from approximately $76 billion (CAGR 10.9%) to an aggressive $168 billion (CAGR 25.53%). This is not a data error; it is a critical reflection of differing market definitions and segmentation criteria – from the narrow, highly-regulated segment of clinical-grade devices to the broader, high-volume consumer wellness market. The table below illustrates this strategic ambiguity by compiling projections from leading research firms.

Market Size Projections (2025-2030)

| Source | 2024 Market Size (USD Billion) | 2025-2030 CAGR (%) | 2030 Projected Market Size (USD Billion) | Key Report Focus/Scope |

| MarketsandMarkets | 41.07 | 10.9 | 75.98 | Global wearable healthcare devices (includes consumer) |

| Grand View Research | 42.74 | 25.53 | 168.29 | Global wearable medical devices (includes consumer) |

| ResearchAndMarkets | 20.87 | 17.44 | 54.78 | Global wearable medical device market |

| Fortune Business Insights | 91.21 | 17.8 | 324.73 (by 2032) | Global wearable medical devices market (includes diagnostic/therapeutic) |

| Mordor Intelligence | 18.56 (NA) | 15.79 (NA) | 38.63 (NA) | North America wearable medical devices market |

| Citrusbug | 42.68 | 25.90 (2025-2034) | N/A | Global wearable medical devices (includes consumer) |

| GM Insights | 120.1 | 16.5 (2025-2034) | 543.9 (by 2034) | Global wearable medical devices market |

For technology leaders and CEOs, strategic planning cannot rely on a single, fixed number. Instead, the focus must be on segmentation:

- A company targeting the regulated clinical space operates in a smaller, high-value domain.

- A company targeting the consumer space addresses a larger total market but faces different competitive dynamics.

Regardless of the baseline, the overall picture is one of robust and sustained expansion, with North America currently dominating the global market with a 46.09% share (2024), driven by innovation and favorable reimbursement policies.

Key Drivers of Market Expansion

Market expansion is being propelled by three powerful, interconnected forces that are reshaping both public health needs and technological capabilities.

1. Demographic Pressures and the Chronic Care Imperative

The foundational demand driver is the aging global population combined with the rising prevalence of chronic conditions such as diabetes and cardiovascular disorders. These conditions affect hundreds of millions worldwide, creating an inherent and expanding public health crisis. This demographic shift necessitates a move toward cost-effective, continuous monitoring solutions outside the hospital, directly fueling demand for devices that can provide real-time health data in the patient’s home.

2. The Shift to Proactive, Home-Based Healthcare

This rising demand is being met by a fundamental change in healthcare philosophy. The model is moving from a reactive, hospital-centric approach to a proactive, preventative, and home-based one. This transformation is an essential response to skyrocketing healthcare costs and is enabled by wearable technologies that facilitate Remote Patient Monitoring (RPM). This shift is clearly dominant, with the home healthcare segment already accounting for the largest revenue share (52.34% in 2024). By providing continuous data, wearables empower timely interventions, significantly reducing the need for expensive emergency visits or hospital stays.

3. Technological Convergence: Sensors and Connectivity

Finally, a favorable environment for growth has been created by the convergence of advanced components. Continuous advancements in sensor technology – from sophisticated MEMS to optical and electrochemical components – have made wearable devices more reliable and accurate. Simultaneously, the proliferation of smartphones provides a ready-made digital ecosystem for data management, while the expansion of high-speed networks, particularly 5G, enables the real-time, low-latency transmission of critical health data, dramatically improving the speed and dependability of remote monitoring.

Geographic Insights: Regional Dominance and Emerging Opportunities

Geographically, the market presents a clear contrast between current leadership and future growth vectors. Driven primarily by the United States, North America currently holds the largest market share (46.09% in 2024). This dominance is secured by a robust healthcare infrastructure, high per capita spending, strong innovation, and favorable reimbursement policies for medical wearables.

However, a critical future growth vector is the Asia-Pacific (APAC) region, which is emerging as the fastest-growing area globally. This region is anticipated to record the highest CAGR, with some analyses projecting growth rates as high as 28.4%. This acceleration is fueled by massive populations, an increasing prevalence of chronic conditions, ongoing modernization of healthcare infrastructure, and government initiatives focused on reducing hospital stays. For any global company, strategically targeting the high-growth markets within APAC is a critical consideration for future market leadership, while maintaining a strong foothold in the high-value North American market.

The New Wave of Medical Wearables: Technologies & Applications

From Passive Trackers to Intelligent Platforms

The evolution of medical wearables is marked by a clear trajectory from simple, single-use devices to sophisticated, multi-functional platforms. This transformation is driven by a critical shift in form factors. While smartwatches remain dominant, the next generation is moving toward seamless integration via adhesive skin patches, smart clothing, and invisible sensors woven into fabrics.

This is not merely a design choice; it is a strategic imperative tied directly to user compliance and data quality. Less intrusive, more flexible devices ensure continuous wear, while close-contact forms (like patches) provide more accurate, noise-free data. For the Chief Technology Officer (CTO), the roadmap must prioritize R&D in:

- Material Science and Miniaturization (e.g., advanced MEMS sensors).

- Biocompatible Materials (meeting standards like ISO 10993).

The strategic objective is to move beyond the wrist and integrate health monitoring into the fabric of daily life, turning a technical challenge into a core competitive advantage.

Deep Dive: Glucose Monitoring Wearables

The diabetes management segment is one of the most rapidly expanding areas, fueled by the global patient population projected to reach 643 million by 2030. This immense need has made the development of a truly non-invasive glucose monitoring device the “holy grail” of the market.

While Continuous Glucose Monitors (CGMs) like the Abbott FreeStyle Libre have reduced the need for frequent finger pricks, they still require a minimally invasive subcutaneous sensor. The new wave of innovation is focused on eliminating this final barrier through technologies such as ultra-low power RF/microwave (e.g., Afon Technology’s Glucowear) or near-infrared light solutions.

Strategic Value Proposition: The elimination of pain and anxiety encourages frequent engagement, which translates into a more comprehensive dataset. For health systems and payers, this abundance of data allows for earlier detection and intervention, offering a clear path to reduced healthcare costs and improved long-term glycemic control – a powerful pathway to broader market adoption and reimbursement.

Beyond Monitoring: The Rise of Therapeutic and Interventional Wearables

While vital sign and diagnostic devices currently hold the largest market share, the therapeutic device segment is poised for the most rapid growth, anticipated to witness the fastest CAGR of 26.71% throughout the forecast period.

This represents the shift from passive data trackers to active, interventional treatment. This trend, known as digital therapeutics or closed-loop systems, automates the cycle of monitoring, analysis, and treatment. Key examples of this transformative shift include:

Digital Therapeutics & Closed-Loop Systems in Focus

| System | Description | Technology & Impact |

| Glucose Monitors & Insulin Pumps | Continuous Glucose Monitors (CGMs) are being paired with closed-loop insulin delivery systems. | This creates a semi-autonomous system that adjusts insulin dosage in real time based on glucose readings, improving glycemic control and reducing the burden of manual intervention for the patient. |

| Neuromodulation Wearables | Wearables that can trigger therapeutic interventions based on signals from an electroencephalogram (EEG). | These devices are being developed for applications such as pain management and neurological disorders, offering personalized, on-demand therapy. |

| TENS Therapy | Transcutaneous Electrical Nerve Stimulation (TENS) therapy controlled by machine learning models. | The system uses data from sensors to dynamically adjust the therapy, offering a more effective and personalized pain management solution. |

The Strategic Imperative of AI and Edge Computing

The integration of Artificial Intelligence (AI) is a central theme in the evolution of digital healthcare, transforming wearables from simple data loggers into intelligent diagnostic platforms. This shift is enabled by the rise of AI at the edge, where data processing occurs directly on the device, not in the cloud.

Performance and Real-Time Intervention

The first advantage of edge AI is the elimination of latency, enabling real-time on-device signal processing for critical biosignals (PPG, ECG, EMG, and EEG). By utilizing low-power neural accelerators, devices can instantly process data and generate faster alerts for critical health events, such as arrhythmia detection or fall detection. This acceleration is crucial for interventional devices, where milliseconds can impact patient safety and outcome.

Security, Privacy, and Trust as a Differentiator

Beyond speed, edge processing offers a critical strategic advantage related to security and privacy. Continuous monitoring generates vast quantities of sensitive physiological data. By analyzing and summarizing this data locally, the device significantly reduces the amount of raw, protected health information transmitted over networks or stored in the cloud.

For the CTO and CEO, this capability transforms a technical feature into a core business value: it inherently lowers bandwidth consumption and, more importantly, reduces the risks associated with data breaches. This forms the basis of a robust “privacy-by-design” approach, which serves as a powerful differentiator that builds user trust in a market increasingly sensitive to data security issues.

Navigating the Business and Regulatory Landscape

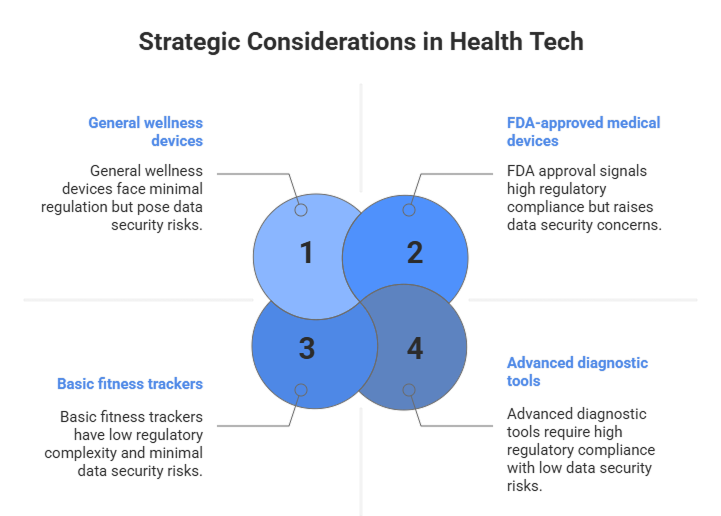

1. The Regulatory Labyrinth: FDA Approval as a Strategic Asset

The complex regulatory environment is both a challenge and a strategic opportunity. In the United States, the Food and Drug Administration (FDA) draws a crucial line: any device intended for diagnosis, treatment, or prevention of disease requires approval, distinguishing it from unregulated “general wellness” devices. The FDA-cleared ECG feature on the Apple Watch is a prime example of a consumer product successfully bridging this gap.

For companies targeting the high-value clinical market, FDA approval is not a mere hurdle; it is a powerful market signal that builds credibility with healthcare providers and patients. Manufacturers must adopt a dynamic regulatory strategy, proactively engaging with the FDA through pathways like the 510(k) premarket notification (for devices “substantially equivalent” to an existing product) or the more stringent PMA (for novel, high-risk devices).

The CEO’s Mandate: Achieving FDA readiness must be a core, non-negotiable tenet of product development, as it provides the clear pathway to transition from the consumer-grade market to the higher-value clinical space, opening new revenue streams and partnerships.

2. Securing the Data Pipeline: Privacy, Cybersecurity, and Trust

The collection of sensitive data – from heart rate to inferred mood – creates a new level of data vulnerability and a significant legal gap. Much of the data from consumer wearables is not protected under conventional legislation like HIPAA, leaving it vulnerable to sale to data brokers and advertisers. This regulatory gray area creates a dangerous information asymmetry, where companies understand the value of the data more than the users generating it, thereby eroding user trust.

Strategic Imperative: For a technology company, a lack of perceived trust is a fundamental business risk that prevents adoption by enterprise clients (e.g., hospital systems). Therefore, robust data security practices are not a luxury but a core pillar of the brand’s value proposition. Best practices must include data encryption (at rest and in transmission), robust access logging, and a commitment to a “privacy-by-design” approach built into the device architecture from the outset.

3. The Competitive Arena and the Shift to SaaS Models

The competitive landscape is dynamic, featuring major consumer electronics giants (Apple, Samsung) alongside established medical device stalwarts (Medtronic, Abbott, Dexcom).

Recent Mergers and Acquisitions (M&A) activity reveals the strategic direction of the market: acquisitions are focused less on hardware and more on specialized data, analytics capabilities, and software platforms. Examples like Datavant acquiring DigitalOwl (AI-driven medical data analysis) and GE HealthCare acquiring icometrix (AI-powered brain imaging) show a clear trend:

The focus is rapidly shifting from hardware-centric business models to models centered on data, analytics, and Software-as-a-Service (SaaS). Success will be defined by the ability to transform raw physiological data into actionable, automated clinical insights.

The 2030 Vision: Strategic Recommendations for Leadership

To successfully navigate the medical wearables market and position for long-term growth, C-suite executives must align their strategy across three integrated pillars: Product Innovation, Technical Architecture, and Market Positioning.

1. R&D and Product Innovation Strategy

The focus of research and development must be directed toward the highest-growth segments to ensure future market leadership.

- Prioritize Therapeutic Devices: Allocate significant R&D spend to the therapeutic device category, which is projected to have the fastest growth rate. This means focusing on closed-loop systems that provide active, interventional care (e.g., integrated CGMs and insulin pumps).

- Invest in Non-Invasive Sensing: Aggressively fund the development of truly non-invasive sensing technologies (such as RF/microwave or near-infrared light). This innovation is the key to capturing the massive untapped market of patients who avoid invasive monitoring, drastically expanding the total addressable market.

2. Architectural and Technical Recommendations

The Chief Technology Officer’s (CTO) roadmap must prioritize security and integration for clinical acceptance.

- Integrate AI at the Edge: Prioritize on-device AI integration to enable faster, more secure data processing. This forms the foundation for secure, interoperable platforms that integrate seamlessly with existing digital health systems.

- Ensure System Integrity: Implement core security features from the outset, including secure boot, encrypted firmware updates, and hardware roots of trust, to build confidence with healthcare providers and enterprise partners.

- Adopt Medical-Grade Design: Mandate “medical-grade design” from the start, utilizing ISO-compliant materials and flexible, biocompatible substrates to maximize user comfort and ensure high data quality.

3. Market Positioning and Growth Strategy

Growth must be driven by a clear, defensible path that leverages trust to access higher-value markets.

Build on Trust and Transparency: A company’s brand must be synonymous with robust cybersecurity and clear, ethical data handling. Implement comprehensive security measures that go beyond basic compliance to demonstrate an unwavering commitment to user data protection.

Adopt a Dual-Pronged Market Entry:

- Consumer Base: Initially target the broad consumer wellness space to rapidly build brand recognition and market share.

- Clinical Transition: Strategically seek FDA clearance for specific features or devices to enter the higher-value clinical market.

The ultimate determinant of success in the 2025–2030 era will be the ability to bridge the gap between consumer-grade health and clinical-grade medicine, transforming a general health company into a credible and trusted medical technology provider.

From Strategy to Solution: The Developex Advantage

The strategic outlook for medical wearables makes two things clear: success demands technical excellence and robust security. At Developex, we translate these imperatives into viable, market-ready digital health products.

Our specialized expertise in the healthcare software development directly addresses the core challenges faced by innovators in the 2025–2030 landscape.

- Firmware and Connectivity: Building reliable, low-power firmware for sensors and ensuring robust, real-time data synchronization over protocols like Bluetooth Low Energy (BLE).

- Companion Applications: Developing secure, user-centric mobile applications that serve as the patient interface, managing data, delivering real-time alerts, and enabling personalized engagement.

- AI-at-the-Edge Readiness: Architecting systems capable of on-device processing to support the critical demand for real-time analysis and enhanced security.

- Building Secure Platforms: We develop the necessary backend and cloud infrastructure for massive data volumes that meets global standards and builds consumer and provider trust.

- EHR and Telehealth Integration: We ensure seamless integration with existing health IT infrastructure, including Electronic Health Records (EHRs) and Telemedicine platforms. This is crucial for transforming raw sensor data into clinically actionable information that can be readily adopted by physicians and health systems.

Final Thoughts

The medical wearables market is moving past wellness tracking toward clinically validated, reimbursable therapeutic solutions, driven by the demand for remote patient monitoring (RPM) and cost-effective care. Success in the 2025–2030 landscape demands flawless technical execution, integrating AI at the Edge for real-time, privacy-enhanced analysis, and prioritizing robust clinical evidence and seamless EHR interoperability. Innovators must treat security, compliance (like HIPAA), and integration as foundational architectural elements from day one.

This is where the specialized expertise of Developex becomes a critical advantage. We focus exclusively on the engineering complexity inherent in digital health, providing the full-stack development capability to transform sensor hardware into secure, scalable, and clinically viable IoMT ecosystems.

Contact Developex today to discuss how our strategic engineering can accelerate your product’s journey from concept to market-ready medical wearables.